TAXPAYER INSTRUCTIONS TO FILE A PROPERTY TAX APPEAL

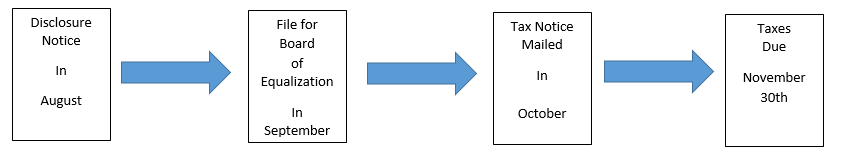

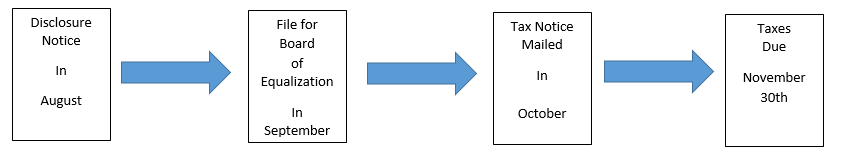

Please review the following when preparing to file a property tax appeal and review your tax notice for instructions on making an appeal appointment.

WHEN PREPARING AN APPEAL OF THE MARKET VALUE OF YOUR PROPERTY

First, remember that the burden of proof is on the taxpayer. You are required by law to present proof of your appeal to the Board of Equalization. Appeals will be dismissed for lack of evidence. When filing an appeal, remember that you are not protesting the amount of your tax bill, but rather you are appealing the property’s market value. Market value is the value, as of January 1, of the current year. The Assessor’s Office establishes the property market value to which the tax rate is applied. The Board of Equalization does not have the authority to change the tax rate. The Board of Equalization does have the authority to review and accept information pertinent to the market value of your property.

WHAT EVIDENCE DO I NEED TO PRESENT TO THE BOARD OF EQUALIZATION?

A current appraisal made by a professional fee appraiser is generally considered the best evidence to establish value.

- If you recently purchased or refinanced your property, your real estate closing papers can be used to support your opinion of value.

- The next best evidence would be recent sales of properties, located in or around your neighborhood, that are similar to yours in size, age, condition, quality.

- Evidence should be based on the tax lien date of January 1st of the current year.

HOW TO FILE THE APPEAL

You must complete the appeal form in full (do not omit any information as this may require you to re-submit the form or lose the appeal).

Five important items that must be included are the following:

- The names address and phone number of the property owner

- The serial number, account number (on your disclosure notice), location (site address), and decryption of the property

- The value placed on the property by the assessor (from your disclosure notice)

- The owner’s estimate of fair market value of the property

- A signed statement describing what evidence or documentation supports the owner’s estimate of fair market value or that the assessed value of the owner’s property is not equalized with comparable properties

AFTER CONSIDERING THE ABOVE INFORMATION, SHOULD I FILE AN APPEAL WITH THE BOARD OF EQUALIZATION?

The decision of whether or not to file an appeal should be based on the results of your market value investigation. If you find evidence that would indicate that the market value of your property should be significantly lower than the value placed on your property by the County Assessor, you may have grounds for an appeal.

Should you decide to appeal the value of your property, it is your responsibility to provide the Board of Equalization with the results of your findings to substantiate your opinion of value.

Download Application

State Appeal Form